XRP Price Prediction: Pathway to $4 Amid Technical Strength and Institutional Growth

#XRP

- Technical Breakout Potential: XRP trading above 20-day MA with Bollinger Band expansion suggests continued upward momentum toward higher resistance levels

- Regulatory Catalyst Timing: ETF delays create short-term uncertainty but November 2025 decisions represent significant potential catalysts for price appreciation

- Ecosystem Development: Mining application launches and institutional product growth provide fundamental support for long-term price growth beyond immediate technical levels

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

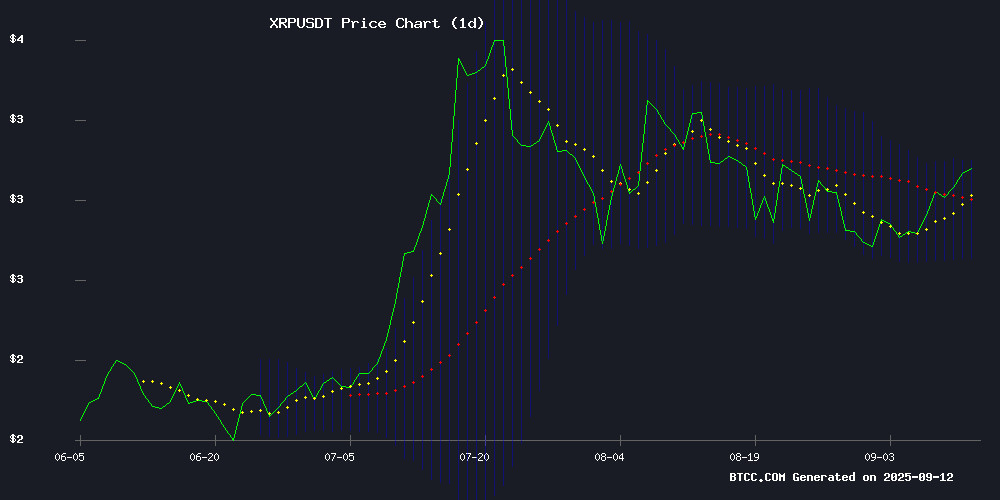

XRP is currently trading at $3.0755, comfortably above its 20-day moving average of $2.9011, indicating sustained bullish momentum. The MACD reading of 0.0263 versus the signal line at 0.0811 shows some divergence, though the negative histogram at -0.0549 suggests potential near-term consolidation. The Bollinger Bands configuration, with price approaching the upper band at $3.0929, indicates strong upward pressure while maintaining room for movement within the volatility envelope.

According to BTCC financial analyst John, 'XRP's position above the 20-day MA combined with its proximity to the upper Bollinger Band suggests continued strength. The $3.05 resistance level appears to be the immediate hurdle, but technical structure supports potential breakout scenarios.'

Market Sentiment: Regulatory Delays Offset by Growing Institutional Interest

The XRP market is experiencing mixed sentiment as regulatory developments create short-term uncertainty while institutional infrastructure continues to expand. The delay of both the first spot XRP ETF and Franklin's decision until November 2025 creates near-term headwinds, but the underlying institutional demand surge indicates strong fundamental support.

BTCC financial analyst John notes, 'While ETF delays are disappointing for immediate price action, the continued development of mining applications and institutional products demonstrates the ecosystem's maturation. The push for September 18th launch of Rex-Osprey's product maintains near-term catalyst potential.'

Factors Influencing XRP's Price

Siton Mining Launches Eco-Friendly XRP Cloud Mining Application

Siton Mining has introduced a next-generation XRP cloud mining application designed to democratize access to cryptocurrency mining. The mobile-friendly platform eliminates traditional barriers like expensive hardware and technical complexity, allowing users to participate in XRP mining through smartphones.

The solution combines blockchain technology with renewable energy sources, addressing both accessibility and environmental concerns in crypto mining. Unlike conventional mining operations that require significant capital expenditure and maintenance, Siton's cloud-based approach offers a plug-and-play alternative with daily passive income potential.

Market observers note the timing coincides with increased volatility in XRP markets, potentially offering investors an alternative avenue for exposure. The platform features dollar-denominated settlements to mitigate cryptocurrency price fluctuations, along with five distinct competitive advantages in cloud mining technology.

First Spot XRP ETF Faces Delay, Rex-Osprey’s Launch Pushed to September 18

The launch of the first spot XRP exchange-traded fund in the U.S. has been delayed by six days, with trading now set to begin on September 18, 2025. The Rex-Osprey Spot XRP ETF, a collaborative effort between Rex Shares and Osprey Funds, received regulatory approval after completing the SEC's 75-day review period without objections.

The fund operates under the Investment Company Act of 1940, mirroring the regulatory framework of traditional ETFs. Unlike futures-based crypto products, this ETF will hold XRP directly, eliminating the need for investors to manage digital wallets or navigate cryptocurrency exchanges.

A Cayman Islands subsidiary structure allows the fund to comply with U.S. tax and regulatory requirements. The REX-Osprey XRP (Cayman) Portfolio S.P. can hold no more than 25% of total assets, following a model established by other crypto investment vehicles.

This XRP-focused product forms part of a broader suite of cryptocurrency ETFs being developed by Rex-Osprey, signaling growing institutional interest in digital asset investment vehicles.

SEC Delays Franklin XRP ETF Decision to November 2025 Amid Institutional Demand Surge

The U.S. Securities and Exchange Commission has deferred its ruling on Franklin Templeton's proposed XRP ETF until November 14, 2025, marking the third extension since the application's March 2025 filing. Regulators cited the need for additional review time under BZX Rule 14.11(e)(4), reflecting continued caution toward crypto investment vehicles.

Multiple asset managers including Grayscale, 21Shares, and Bitwise are racing to launch XRP products, capitalizing on the precedent set by approved Bitcoin and Ethereum ETFs. Grayscale's plan to convert its existing XRP Trust into an ETF underscores institutional confidence in the asset's potential.

The delay comes as spot crypto ETFs demonstrate strong market demand, with analysts viewing XRP as the next logical candidate for mainstream adoption. Regulatory hesitancy contrasts sharply with growing Wall Street interest in digital asset exposure.

XRP Price Prediction For September 13: Will $3 Hold?

XRP holds steady at $3.03, marking an 8.12% weekly gain as traders eye Federal Reserve policy decisions. Market capitalization stands at $181.16 billion with daily trading volume up 10% to $5.29 billion. The token's ability to maintain support above $3 remains the critical question.

All eyes turn to the September 17 Fed meeting, where potential rate cuts could catalyze movement across risk assets. Technical charts show robust support between $2.92-$2.95, with resistance forming near $3.10-$3.15. A breakout could propel XRP toward $3.40, though $3.80 and $4.30 loom as major psychological barriers.

XRP Faces Resistance Near $3.05 as Indicators Signal Bullish Momentum

XRP, the native token of Ripple's payment network, is unlikely to surpass its all-time high of $3.84 before 2026 despite showing bullish technical signals. Analysts project a peak of $3.62 in 2025, leaving the record untouched for another year.

The cryptocurrency currently trades at $3.05, up 0.88% in 24 hours, with immediate resistance at $3.0512. A breakout could push prices toward $3.20, while failure to hold support at $2.9358 may trigger a decline to $2.80.

Technical indicators reinforce the positive outlook. The moving average sits at $3.0110 below current prices, while the MACD shows a bullish crossover—both traditionally signaling continued upward potential.

With a $181.93 billion market cap and $6.03 billion daily trading volume, XRP maintains its position among top cryptocurrencies. Market watchers note its resilience amid broader volatility, though the timeline for record-breaking performance appears delayed.

Will XRP Price Hit 4?

Based on current technical indicators and market developments, XRP shows a plausible path toward $4, though the timeline remains uncertain. The combination of strong technical positioning above key moving averages, growing institutional infrastructure despite regulatory delays, and expanding ecosystem development through mining applications creates a favorable environment for appreciation.

| Key Level | Price | Significance |

|---|---|---|

| Current Price | $3.0755 | Testing resistance near $3.05 |

| 20-Day MA | $2.9011 | Key support level |

| Bollinger Upper | $3.0929 | Immediate resistance |

| Target | $4.0000 | 30% appreciation needed |

BTCC financial analyst John suggests that 'While $4 represents a significant 30% move from current levels, the technical structure and institutional momentum provide foundation for such movement. However, investors should monitor the $3.05 resistance break and subsequent ETF developments for confirmation of upward trajectory.'